2025 Tax Brackets: Married Jointly. Dependent the greater of $1,300 or $450 + dependent’s :. Your taxable income and filing status determine both the tax rate and bracket that apply to you, outlining the amount you’ll owe on different portions of your income.

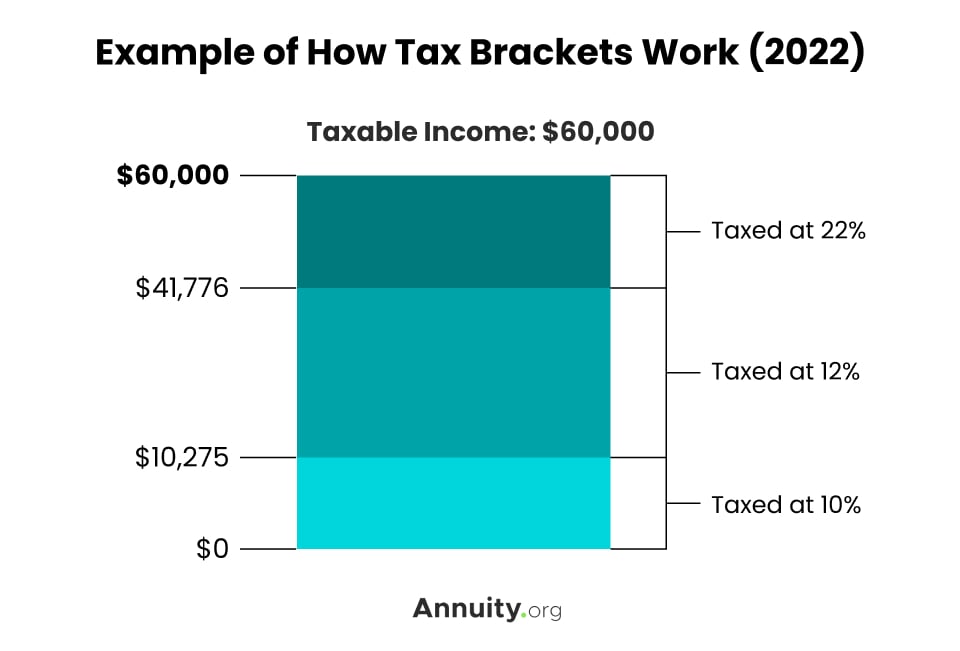

This means that the standard deduction for married couples filing jointly will rise to $29,200, an increase of $1,500 from the current tax year. In the u.s., there are seven federal tax brackets. You pay tax as a percentage of your income in layers called tax brackets.

2025 Alternative Minimum Tax (Amt) Exemptions Filing Status

For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing. Single filers and married couples filing jointly;

12% For Incomes Between $11,001 To $44,725.

Rather, you get taxed at different rates as your pay transcends brackets.

2025 Tax Brackets: Married Jointly Images References:

Source: neswblogs.com

Source: neswblogs.com

Irs Tax Brackets 2022 Married Jointly Latest News Update, For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing.

Source: hkglcpa.com

Source: hkglcpa.com

Tax Rates Heemer Klein & Company, PLLC, For tax year 2023, or the taxes you file in april 2025, these are the tax brackets and income thresholds for the various filing statuses:

Source: www.annuity.org

Source: www.annuity.org

Tax Brackets for 20232024 & Federal Tax Rates, In the u.s., there are seven federal tax brackets.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, Anyone with an adjusted gross income of up to $79,000 can file their federal tax returns (and some state returns) for free using the irs’s free file system.

Source: modernhusbands.substack.com

Source: modernhusbands.substack.com

The 2023 Tax Brackets by Modern Husbands, Single or married filing separately — $13,850.

Source: www.the-sun.com

Source: www.the-sun.com

brackets reveal your tax rate as deadline to file 2021 taxes is, For the tax year 2025, the standard deduction for married couples filing jointly will increase to $29,200, an increase of $1,500 over the tax year 2023.

Source: www.chime.com

Source: www.chime.com

Tax Season Guide Married Filing Jointly vs. Separately Chime, Dependent filing own tax return.

Source: www.hotzxgirl.com

Source: www.hotzxgirl.com

Tax Brackets Irs Married Filing Jointly Hot Sex Picture, Tax rate single filers married couples filing jointly married couples filing separately head of household;

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Dependent the greater of $1,300 or $450 + dependent’s :.

Source: boxden.com

Source: boxden.com

Oct 19 IRS Here are the new tax brackets for 2023, For 2025, inflation adjustments increased the size of tax brackets by about 5.4%.

This Means That The Standard Deduction For Married Couples Filing Jointly Will Rise To $29,200, An Increase Of $1,500 From The Current Tax Year.

In other words, in 2025, a married couple filing jointly would pay 10% on their first $23,200,. 10% for incomes between $0 and $11,000.

In This Article, We Will Explore The Tax Brackets For Married Couples Filing Jointly In 2023 And 2025, Providing You With Valuable Insights To Navigate The Tax Landscape.

You pay tax as a percentage of your income in layers called tax brackets.

Posted in 2025